Introduction

The management of a big company has to deal with many different issues that range from internal to external matters. There are many controllable and uncontrollable elements in the business environment. The business has to deal with all of these, although dealing with the uncontrollable ones is the most difficult part. Strategic management is a vital component to handle these elements and advance the organisation in a planned way. Strategic management can be defined as establishing goals and objectives for the company and devising an appropriate course of actions to attain those objectives (Dess and Miller, 2008). It deals with setting strategies and goals, allocating resources and responsibilities, planning organisational structure, assessing the internal and external environment, etc. This report will describe the different components of the strategic management of British Airways (BA), the flag carrier airline of the UK. It was established in 1974 (Britishairways, 2016). Regarding fleet size BA is the largest airline company in the UK. Currently, BA serves nearly 183 destinations around the world. It has in its fleet nearly 290 aircraft of various models and sizes from Boeing and Airbus (Grundy, 2004). Throughout the discussion, different strategic management models and frameworks have been used. The ranges of issues that have been discussed in this report include external and internal environmental analysis of BA, the resource-based view and value chain analysis, PR crisis of BA and business and corporate level strategy of the company. In the end, some recommendations have been developed for BA to improve its strategy and service.

Question 01

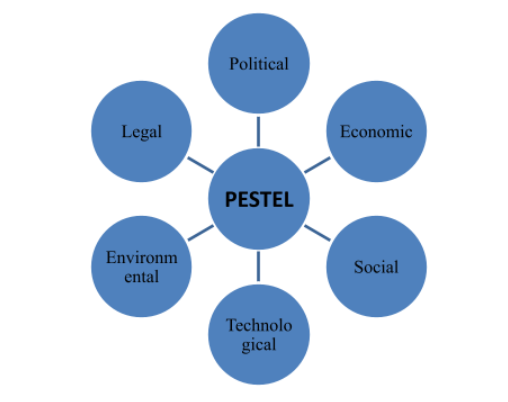

Macro Environment Analysis (PESTEL)

The macro-environment consists of the external forces surrounding the business. PESTEL is an established tool to carry out macro-environmental analysis. It stands for political, environmental, social, technological, economic and legal factors. For example, the PESTEL analysis of British Airways (BA) is carried out below:

Political factors

The airline industry is one of the few highly regulated industries in the world. Moreover, following the terrorist attacks in London, Spain and the recent one in Paris, the security measures and regulations have been tightened in the European Union (EU) region. In the EU, passenger rights are regulated by the 261/2004 regulation, which is concerned about the rights and obligations of the passengers about the cancellation, delays and denied boarding of the flights (Ec.europa, 2016). In addition, this regulation has set out the rules on compensation and assistance to the passengers on the issues mentioned above. Besides, as an industry member, BA also has to comply with the International Aviation Organization (ICAO) regulations.

Economic factors

Since the end of the 208 financial crisis, the world economy has been advancing at a rate of 2 per cent annually (Bonova et al., 2014). Moreover, the recent lower price of oil has accelerated the growth of the industry. But the weakening of the pound against the Euro has put stress on the companies, including BA. On the other hand, the threat of terrorism has resulted in enhanced insurance cost.

Social factors

A large portion of the EU people is getting older. This segment of the people will opt for leisure and travel to pass their time. This segment of the people has a spending capability of nearly £50 billion (Button, 2009). So, it can be expected that in the coming year’s airlines will see more passengers from this customer segment and hence arrange necessary facilities within the aircraft to facilitate their travel.

Technological factors

Most of the airlines in the industry now offer online booking and self-check-in service. According to recent statistics, 34% of travellers now use price comparison sites before deciding on which airline to travel to (Staniland, 2008). So, the companies are now investing heavily in technological innovation.

Environmental factors

The EU has developed some regulations to make the aviation industry more environmentally friendly. “Clean Sky” will be the flagship regulation in this regard. According to this, fuel consumption has to be reduced by 50% per passenger by 2020 and carbon emission must be brought down by 50% within the same period (Talbot, 2010). Following this regulation, the airline companies have developed their respective sustainability practices.

Legal factors

The operating companies have to abide by relevant laws and regulations regarding employment, reporting, investment, taxation etc.

Micro Environment Analysis (Porter’s 5 Forces Model)

Based on the above discussion, it can be said that the industry is fairly competitive yet profitable. As the number of passengers rises and the popularity of airlines as travel options increase, the sector is set to be more attractive in the coming years. As a result, the sector is expected to grow at 4.4% annually in Europe (Bonova et al., 2014). From the level of competition and size of the industry (110 billion Euro), it can be said that the industry is at its maturity level and with time, it will grow further matured.

Question 02

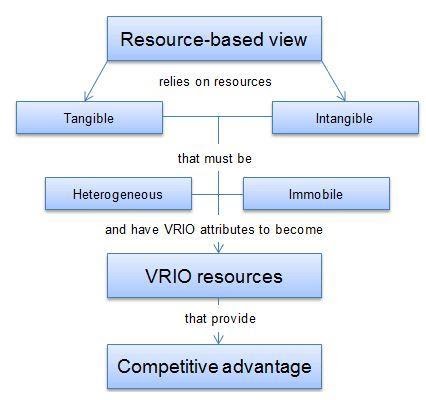

A resource-based view of British Airways

Resource-Based View of RBV is a concept based on the assumption that a company’s internal resources are valuable in attaining competitive advantage (Harvey, 2007). The ability of a firm to attain and sustain a competitive advantage lies in the strengths of its assets and its abilities to outperform those of the competitors. However, for the resources to render a competitive advantage, they have to have certain characteristics. The resources have to be valuable, rare, inimitable and non-substitutable. These characteristics are, in short, known as VRIN. In the following discussion, VRIN characteristics of BA will be found out:

Valuable: For the resources to be valuable, they have to trigger a value-creating strategy. Values can be created either by performing better than the competitors or removing the form’s weakness (Hitt et al., 2011). In the case of the BA, the big fleet of aircraft of the company can be its valuable resource. Currently, BA has more than 200 aircraft in its fleet, and the company serves around destinations of the world. BA has served these many destinations effectively only because of the large fleet of technologically advanced aircraft it has managed to maintain. Moreover, the Oneworld airline alliance can be termed as a valuable resource for the company. BA was the founding member of the alliance and now comprises five members, including BA. This alliance has enabled BA to serve wide ranges of destinations with quality services.

Rare: Rareness is a characteristic of the resources that are not seen in the resources of the other companies. BA is the only airliner in the UK that has access to terminal 5 of Heathrow airport. This rare access has enabled the company to serve customers effectively and reduce time and operation costs in serving the customers. During the economic crisis, the operations at Terminal 5 resulted in significant cost saving for the company.

In-imitable: It refers to the inability of the competitors to copy the resources. In the present business world, it is difficult to keep any aspect of business inimitable. However, the competitors may find it difficult to imitate the service pattern of BA. Particularly, the in-flight service pattern of the company can hardly be copied as it is the result of years of research and experience and training of the BA staff. BA has separate training schools for its staff. In fact, BA has attained the NVQ Level 2 certification, which is the first airline in the UK to gain such certifications (Maughan et al., 2009).

Non-substitutable: The competitors cannot substitute the value-creating resources. Among the resources mentioned above, only the aircraft of the company can be substituted. However, the competitors cannot substitute the BA employees’ service pattern and skills and experience. However, the biggest non-substitutable resource of BA is its operations at terminal five at the Heathrow airport. This terminal was specially built for BA, keeping in mind its long-term growth strategy (Peoples, 2012). Any other UK airline company can hardly find out its infrastructure at the busy Heathrow airport.

From the above discussion, it can be said that superior customer service and a wide range of destinations are the core competencies of BA. BA wants to provide its customers with superior flying experiences with a wide choice of destinations. This strategy falls within the differentiation strategy of Porter’s generic strategy. BA wants to differentiate its services by dint of superior customer experience, and for this purpose, terminal 5 has been refitted with restaurants, shops and luxurious lounges.

Value chain analysis of BA

In BA, the value chain activities are divided into two phases, primary and support activities.

The primary activities of the company are carried out in line with the operational strategy of BA. Moreover, the company uses its alliance and financial resources to bring down cost and provide customer service. BA has implemented advanced technologies in its logistics operations. These include self-check-in, online ticket booking, enhanced security of luggage etc. (Powell, 2014). On the other hand, management renders the UK City and Guilds approved professional training to its employees that has been immensely helpful in carrying out both primary and secondary value chain activities of the company.

BA gains cost reduction in its operations and procurement functions through its economies of scale and strong financial conditions (Reeves, 2005). Again BA is using its financial strength to improve its infrastructural facilities. The company has signed agreements to purchase new Airbus and Boeing aircraft. It has also invested heavily into terminal 5, which is the heart of BA’s UK operation.

From the above discussion, it is evident that BA puts customer comfort and service at the heart of its operation. All value chain activities are intended to improve operational efficiency and render maximum service to the passengers.

Question 03

Issues that affected the image of BA

Not all the time a business can render perfect services. Disruptions do occur despite strong efforts from the company side. It is at this moment when public relation problems are triggered. In order to handle such situations, a company has to administer both public relations and reputation management tactics simultaneously. The harm once done by an unwanted situation cannot be retrieved. However, through public relation and reputation management tactics, the situation can be eased, and the stakeholders’ reliance can be retrieved to some extent.

Since commencement, several issues have affected the image of BA. One of them is the terminal five crisis, also known as the T5 crisis. The problem at terminal 5 originated on the day of the inauguration of the new terminal built only for BA to facilitate operation handling and render enhanced customer service. Terminal 5 was built with £4.3 billion. However, nearly 208 flights were either cancelled or delayed in the first three days of operation (News.bbc, 2016). On top of that nearly 28, 000 bags could not be given back to their owners (News.bbc, 2016). Due to a technical fault, the 30-mile long conveyor belt of terminal 5 was stopped, and it created a backlog of hundreds of thousands of bags at the airport. The incident resulted in mass negative publicity and huge criticism in the media. BA management was flooded with complaints. Moreover, it put into question the very necessity of terminal five and the operational efficiency of BA.

If the above incident is analysed from a reputation management perspective, it can be said that the incident should not have happened in the first place (Collett, 2010). This is the first concept of reputation management. The incident took place somehow, and the BA management should look into what caused the matter in the first place and ensure the presence of elements that can help avoid such an incident in the future. In a crisis, the company should take responsibility for the actions that happened. Although the BA spokesman arranged a media meet and apologised for the incident, the spokesman did not answer any questions from the media that further resulted in deepened confusion and frustration about BA. In the aftermath of such an incident, radical steps could have been taken to improve the situation, like BA could shut down the terminal for some days and reopen it when the issue is solved. Although it is not a proven crisis management method, sometimes it may work (Boxuk, 2016). If Terminal 5 shut down, the problem could have been easily identified and solved. However, BA management thought of opening the terminal and solving the issue simultaneously. Buying goodwill is the important last step of crisis management (Collett, 2010). It is the act of doing something more, something extra for the customers to which they are not entitled. After the incident had occurred, BA management gave only £100 to each passenger to book a hotel room, although the actual cost was far more than that. In that case, BA could book the hotel for the passengers and give them free food. By doing so, the rage of the passengers could have been brought down significantly. Although it costs much more to the company in the short term, it can do a lot of good to its reputation in the long term.

From the above discussion, it is evident that BA was not quite successful in handling the T5 incident better from a reputation management point of view. BA could have done much more or acted more wisely to appease the satiation. They took responsibility for the incident to some extent; however, they failed in terms of buying goodwill and taking radical steps.

Question 04

The business-level strategy of BA

Business-level strategy is more specific. It is targeted towards a specific product or service so that the targeted service or product can be improved utilising the strength and core competency of a company. It is also aimed at solving a particular problem facing a specific product or service. In this part of the report, the business level strategy of BA will be explored using Porter’s generic strategy model.

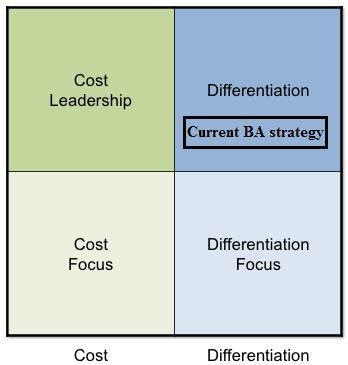

Porter’s generic strategy of BA

Suggested by Michael Porter in 1980, the generic strategy outlines how a company can gain a competitive advantage in a competitive landscape. Mr Porter suggested that a company may attain a competitive advantage through cost minimisation, market differentiation and focus strategy (Porter, 1985). Under cost strategy, a company tries to be the low-cost product manufacturer in the market. Under differentiation strategy, a company tries to differentiate itself by dint of either good service, employee skill or distribution efficiency (Porter, 1985). In focus strategy, a company focuses on a small market segment and tries to serve them in the best possible way. In other words, the market segment is also known as a niche market.

From the analysis of BA’s publicly available strategic papers and discussion from the VRIN analysis, it can be said that BA is currently pursuing the differentiation strategy.

The company wants to differentiate itself by dint of superior service and unique customer experience. BA aims to be the first choice of passengers for global long-haul travel (Britishairways, 2016). The company wants to render unique premium service to its customers whenever they come to BA. BA wants to make passengers feel that their service is worth paying for the service passengers are getting through superior service. It is mentionable here that terminal five has played a vital role in the current and future BA strategy. The same terminal has been kept at heart in the long-term growth strategy of the company as well.

The corporate level strategy of BA

Corporate-level strategies are the companywide strategies aimed at the company’s strategic growth and sustenance (Dess and Miller, 2008). The decisions like human resource decisions, merger and acquisitions, financial performance and resource allocation, etc., are considered the corporate level strategy of the business. The corporate level strategy of BA will be discussed with reference to Ansoff’s product/market expansion grid.

Ansoff’s product/market grid of BA

According to Ansoff’s matrix, there are four possible growth options available to a company. Under the market development strategy, a company can expand into new markets with existing product lines (Ansoff, 1979). A company can go for an enhanced market share in the current market with the current product line in a market penetration strategy. A company can go for increasing market share in the existing product line with the new product line in the product development strategy. On the other hand, a company goes for new market segments with a new product line (Ansoff, 1979). A company may pursue either one or multiple strategies.

An analysis of BA’s strategic planning indicates that the company wants to pursue the market development strategy. As part of the future growth strategy, the company wants to expand into new market segments globally with its existing fleet of aircraft. Indeed, it is a good decision by the BA management following the positive growth rate in the airline industry. The industry is expected to grow by 31% by 2017 (Grundy, 2004).

BA has planned to be the first choice of individual and business traveller across the globe. However, expanding globally is a costly affair. So the BA management has gone for different types of methods to implement the plan that includes partnership, alliance, purchase of other airline companies, merger etc. BA formed the Oneworld alliance with four other airline companies from Australia, the USA and Canada Staniland, M. (2008). Moreover, BA merged with Iberia in 2011, forming the International Airlines Group (IAG), the second-largest airliner in Europe. Besides, BA purchased L’Avion in 2008 as part of its strategic growth action plan (Truxal, 2012). So it is seen that BA has not confined itself to any specific implementation method to execute its strategy. Rather the company is using whatever option is available and convenient to grow and sustain.

Suggested strategy for BA

From the above discussion, it is evident that BA wants to ensure its presence in as many destinations as possible while being the top class service provider. In line with the strategic planning, the company has gone for the differentiation and market development strategy. Keeping in mind the current trends in the airline industry and the company’s resource capability, the adopted strategies seem right and relevant. However, there is room for development in the adopted strategies. Along with differentiation, BA may go for the cost strategy. In the airline industry, jet fuel consumes a significant amount of money. So, BA may go for the fuel-saving aircraft model that will eventually help it to attain cost-effectiveness. In this regard, the company may go into an R&D partnership with Boeing or Airbus to research the cost-effective aircraft model. Moreover, it may enhance automation to reduce workforce needs in its operation, leading the company towards implementing a cost strategy. Moreover, BA can go for standardisation of aircraft models to reduce maintenance cost. At the same time, the company can deepen the reach of the alliance it is involved with to reduce the burden of cost.

Evaluation of the suggested BA strategies

The SAF model

So, the strategies followed by BA are generating a good return for the company. However, it has to be remembered that the airline industry is very dynamic and competitive, and hence the suitability of the adopted strategy may change from time to time (Dess and Miller, 2008). The feasibility of the selected strategy may not always produce the expected result for BA as the market conditions continuously change. Hence, the strategy requires adaptation to the changing situations. The stakeholders often question the acceptability of the BA strategy as the company became subject to criticism several times, as outlined in the previous section (Maughan et al., 2009). This created a PR crisis for the company. The acceptability of the strategy may be improved by engaging all the relevant stakeholders in the decision-making process. Ongoing suitability and feasibility may be improved by making the BA strategy flexible to adapt to the changing business scenario (Button, 2009).

STAIR Model

According to the STAIR model, BA’s management can be considered as the design of the functions. BA has gained an enormous reputation owing to its outstanding services, the behaviour of the employees and overall superior management of the company (Button, 2009). Through adequate internal planning and proper utilisation of the available resources, the company has been running its global operation quite successfully. Moreover, with the technologically advanced aircraft fleet and years of experience, the company management has gained enough expertise in airline management.

Conclusion

Many elements can impact the business processes and decisions taken. BA has to constantly monitor those elements to assess their significance to the organisation and take decisions accordingly. The company may conduct environmental scanning to assess the degree of importance or threat of a particular element. At the same time, it has to keep an eye on the actions and decisions taken by the competitors. As clarified in the earlier section, the airline industry is a competitive one, and the companies are in constant price wars against one another. In order to sustain the edge over the competitors, BA should keep its offers slightly above those of the competitors. In that way, the company can meet both customers’ needs and retain its position.

The business world is fast changing. Different external components are shaping the destiny of the businesses. If a business does not cope with the change, it may fall behind and fail to stay relevant to the trends. So, BA has to be flexible to comply with the changes taking place around the business world. Flexibility has to be adopted in terms of business decisions taken and strategy formulated.

Customer needs and wants are at the heart of BA’s strategy. The management has to sense the needs of the customers and prepare the business accordingly. Apart from the traditional means of collecting customer information, the management can go to social media to get customer feedback. BA can get honest feedback from customers through this medium and use that as raw input in the decision-making process.

The future of the aviation industry is predicted to be more competitive with very high growth potential. If BA can properly formulate the strategic management process involving all the relevant stakeholders, the company can go into the future with the right decisions and the right strategic approach.

References

Ansoff, H. (1979). Strategic management. New York: Wiley.

Boxuk.com. (2016). Box UK. [online] Available at: https://www.boxuk.com/insight/blog-posts/six-metrics-for-measuring-online-reputation [Accessed 23 Mar. 2016].

Bonova, L., Koska, D. and Specker, A. (2014). Consolidation of the EU airline industry.

Britishairways.com. (2016). Book Flights, Holidays & Check In Online | British Airways. [online] Available at: http://www.britishairways.com/travel/home/public/en_gb [Accessed 15 Mar. 2016].

Button, K. (2009). The impact of US–EU “Open Skies†agreement on airline market structures and airline networks. Journal of Air Transport Management, 15(2), pp.59-71.

Collett, H. (2010). Flurry of activity sparks dismal aviation industry. Hospital Aviation, 6(3), pp.10-15.

Dess, G. and Miller, A. (2008). Strategic management. New York: McGraw-Hill.

Ec.europa.eu. (2016). Internal market – Transport. [online] Available at: http://ec.europa.eu/transport/modes/air/internal_market/index_en.htm [Accessed 14 Mar. 2016].

Grundy, T. (2004). Rejuvenating strategic management: the Strategic Option Grid. Strat. Change, 13(3), pp.111-123.

Harvey, G. (2007). Management in the airline industry. London: Routledge.

Hitt, M., Ireland, R. and Hoskisson, R. (2011). Strategic management. Cincinnati: South-Western College Pub.

Lspr-education.com. (2016). PR courses, Social Media & Marketing training, LSPR London – LSPR, PR and Reputation management. [online] Available at: http://www.lspr-education.com/about-lspr/lspr-pr-and-reputation-management.html [Accessed 20 Mar. 2016].

Maughan, J., Raper, D., Thomas, C. and Gillingwater, D. (2009). SCAN-UK ? a network approach to environmental best practice in the aviation industry. Eco-Mgmt. Aud., 8(4), pp.240-247.

News.bbc.co.uk. (2016). BBC NEWS | UK | 28,000 bags caught in T5 foul-up. [online] Available at: http://news.bbc.co.uk/2/hi/uk_news/7323198.stm [Accessed 21 Mar. 2016].

Peoples, J. (2012). Pricing behavior and non-price characteristics in the airline industry. Bingley, UK: Emerald Group Publishing Ltd.

Porter, M. (1985). Competitive advantage. New York: Free Press.

Powell, T. (2014). Strategic management and the person. Strategic Organization, 12(3), pp.200-207.

Reeves, T. (2005). Communication clarity in strategic management data sources. Strategic Organization, 3(3), pp.243-278.

Staniland, M. (2008). A Europe of the air?. Lanham: Rowman & Littlefield

Talbot, C. (2010). The Battle for the Skies: Recent Legal Developments in the EU and US, and their Implications for the Consolidation of the Airline Industry. SSRN Electronic Journal.

Truxal, S. (2012). Competition and regulation in the airline industry. Milton Park, Abingdon, Oxon: Routledge.